How Long Should You Keep Business Tax Records and Receipts?

Reliable record keeping allows businesses to prepare financial statements that help business owners keep tabs on their expenses. However, many companies aren't sure how long tax records and receipts need to be saved in the era of paperless transactions and cloud-based systems. Record keeping is a dull subject matter, but it's an essential task as if you make the wrong choices, you face litigation and problems with the IRS. Understanding how long you should keep these records will help you avoid these problems.

How long do you need to keep tax records for?

The IRS states you need to keep your records "as long as needed to prove your income or deductions on a tax return"; this means you need to keep your tax records for three years from the date your return was submitted. For example, if you file your 2018 tax return a few months ahead (February 15, 2019) of the deadline, this means you need to keep all receipts, tax records, and all additional documentation related to the return until April 15, 2022 -- three years after the 2018 deadline.

Why Three Years?

The three-year rule is due to the period of limitations, which is the time during which you can amend your tax return or in the time when the IRS can perform an audit. When the period of limitation expires, you are no longer required to keep the tax return or supporting documentation.

Exceptions to the Rule

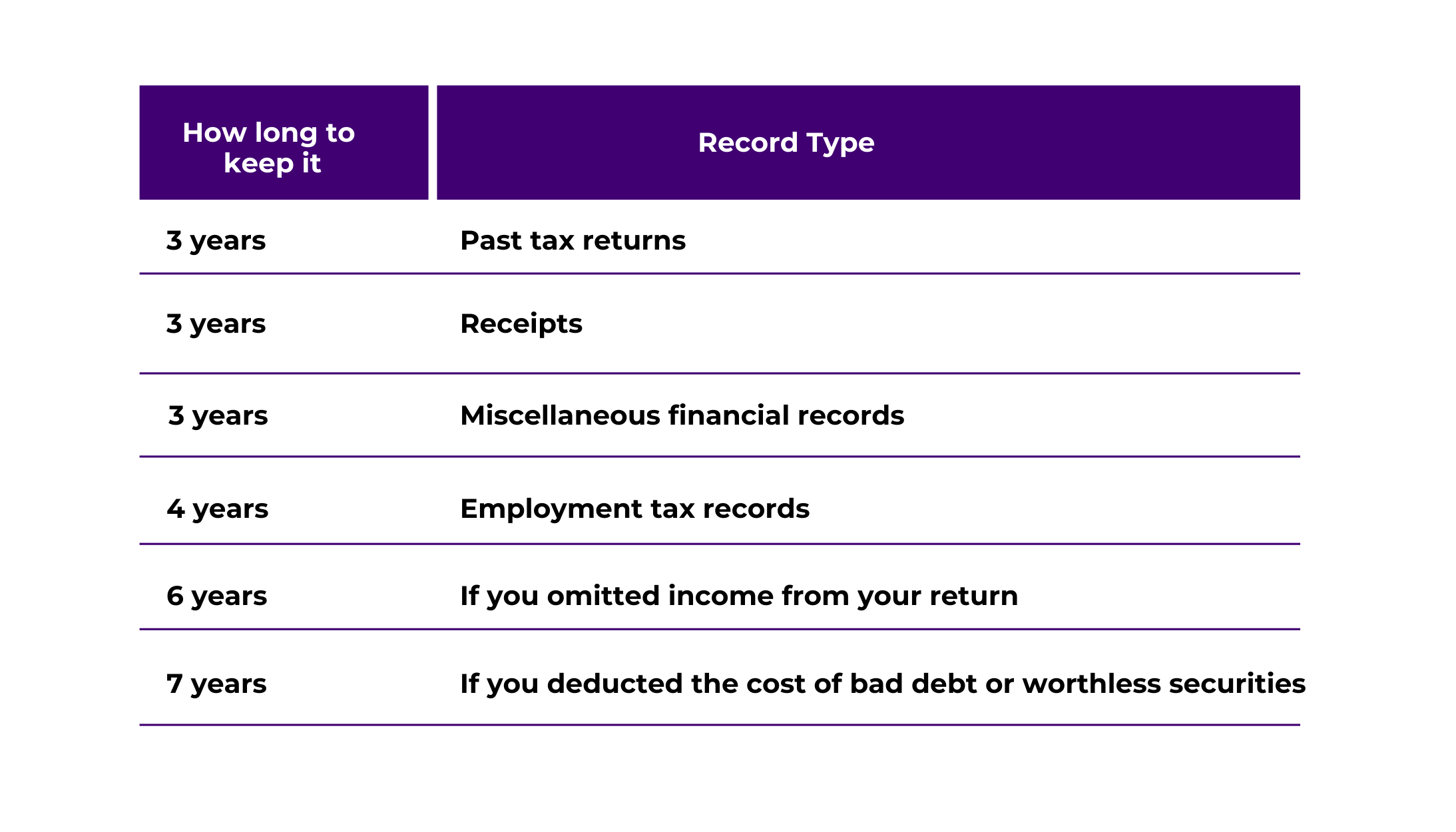

In some instances, you’ll need to hold on to tax records for longer than three years.

Examples include:

• Employee Records should be kept for four years after the payroll tax is due

• You omitted income from your tax return, keep those records for six years after you file

• You deducted bad debt, keep those records for seven year

What’s the best way to keep important documents?

The IRS states you can use any record keeping system as long as it "clearly shows your income and expenses." Many people think this means keeping a shoebox full of paper receipts. However, in the digital age, it's best to go paperless.

The IRS accepts digital copies of all documents as long as they are identical to the paper versions. So, note that if the IRS requests a paper copy, you must produce one.

Creating a digitized version of your essential records is a great way to avoid accidentally tossing small scraps of paper during spring cleaning. Its recommended to scan every document or receipt in your business, save it with a descriptive name, and then archive it.

Secure cloud storage services like Dropbox, Evernote, or Google Drive help make digital record keeping easier. Any of these websites will support scanning and storing.

Remember, to keep a backup of all digitized records in a secure second location, like a password-protected hard drive, or a secondary cloud storage service.

While tax time might be the most critical time for business record keeping, taxes aren't the only reason to keep these documents. Before you toss anything, double-check to see whether they're for another reason. Insurance claims or lawsuits may require records from previous events, so it's essential to review with your internal team before tossing them.

If there's ever any doubt about whether you should keep a receipt or document, keep it. You'll thank yourself at tax time or if you find yourself at the wrong end of an audit.